Price: $4.99

(as of Apr 09, 2025 08:27:29 UTC - Details)

What is the Best Mileage Credit Card? A Comprehensive Guide

Introduction

In today’s world, the right credit card can make a significant difference in how you travel and manage your finances. If you're looking to maximize your travel experience, understanding what the best mileage credit card is can be a game-changer. Mileage credit cards reward you with points or miles for every dollar you spend, which you can then redeem for flights, hotel stays, and other travel perks. In this guide, we’ll dive deep into various aspects of mileage credit cards, helping you discover how to choose the best one for your needs.

Understanding Mileage Credit Cards

What Are Mileage Credit Cards?

Mileage credit cards are specifically designed to earn you travel miles or points. These cards often come with various benefits, including sign-up bonuses, travel insurance, and no foreign transaction fees. If you travel frequently, a mileage credit card can help you accumulate rewards that lead to free or discounted travel.

Why Choose a Mileage Credit Card?

Choosing a mileage credit card can provide numerous benefits. For frequent travelers, these cards offer the chance to earn points that can be redeemed for flights, hotel stays, and other travel-related expenses. Additionally, many mileage cards provide perks like priority boarding, free checked bags, and access to airport lounges.

Key Features to Look for in a Mileage Credit Card

Sign-Up Bonuses

One of the most attractive features of mileage credit cards is the sign-up bonus. Many cards offer significant points or miles after you spend a certain amount within the first few months of opening the account. This bonus can give your travel plans a considerable boost right from the start.

Earning Rates

When choosing the best mileage credit card, consider the earning rates on various categories of spending. Some cards offer higher miles for travel-related purchases, while others may have bonus categories like dining or groceries. Look for a card that aligns with your spending habits to maximize your rewards.

Redemption Options

Understanding how you can redeem your miles is crucial. Some cards allow you to transfer your miles to airline partners, while others provide a straightforward redemption process for booking flights directly. Compare the flexibility and value of redemption options when evaluating your choices.

Annual Fees

Many mileage credit cards come with annual fees. While some may seem high, consider the benefits you’ll receive in return. If the perks outweigh the cost, it may be worth investing in a card with an annual fee. Always calculate how much you would need to spend to offset the fee with rewards.

Popular Mileage Credit Cards

Chase Sapphire Preferred Card

The Chase Sapphire Preferred Card is often considered one of the best mileage credit cards available. With its generous sign-up bonus and flexible points redemption options, it appeals to many travelers. You earn 2x points on travel and dining and 1 point per dollar on all other purchases. The points can be transferred to various airline partners, providing excellent value for frequent flyers.

American Express Gold Card

The American Express Gold Card is another strong contender. Known for its high earning rates on dining, you can earn 3x points at restaurants and 1 point on other purchases. This card also offers a welcome bonus and various travel perks, making it a great option for those who enjoy dining out while traveling.

Capital One Venture Rewards Credit Card

If you’re looking for a straightforward rewards program, the Capital One Venture Rewards Credit Card might be your best bet. It offers 2x miles on every purchase, making it easy to accumulate rewards without worrying about spending categories. Plus, the miles can be redeemed for travel expenses, giving you flexibility.

How to Maximize Your Mileage Credit Card Rewards

Use Your Card for Everyday Spending

To truly benefit from a mileage credit card, use it for everyday expenses. Whether it’s groceries, gas, or dining out, incorporating your mileage card into your daily spending can help you rack up points quickly. Just be sure to pay off your balance each month to avoid interest charges.

Take Advantage of Bonus Categories

Many mileage credit cards offer bonus points for specific categories. Familiarize yourself with these categories and adjust your spending habits accordingly. For instance, if your card offers extra points for travel-related expenses, prioritize booking flights and hotels with your card.

Monitor Promotions and Offers

Keep an eye out for promotional offers from your credit card provider. These can include limited-time bonuses for certain spending categories or increased earning rates for specific purchases. Taking advantage of these promotions can significantly boost your rewards.

Common Myths About Mileage Credit Cards

You Have to Be a Frequent Traveler

A common misconception is that only frequent travelers can benefit from mileage credit cards. While these cards are certainly advantageous for those who travel often, occasional travelers can also find value in the rewards and perks they offer. If you travel even a few times a year, the benefits can add up quickly.

You’ll Never Use All Your Miles

Another myth is that people often don’t use their miles before they expire. While it’s true that some mileage points have expiration dates, many credit card companies have flexible policies that allow you to keep your points as long as your account remains active. Regularly using your card can help prevent point expiration.

All Mileage Cards Are the Same

Not all mileage credit cards are created equal. Each card has its unique features, benefits, and earning potential. It’s essential to do your research and find a card that suits your lifestyle and spending habits.

Conclusion

In conclusion, choosing the best mileage credit card can significantly enhance your travel experience by providing valuable rewards and benefits. Consider factors such as sign-up bonuses, earning rates, redemption options, and annual fees when making your decision. With the right mileage credit card in your wallet, you can turn everyday spending into unforgettable travel experiences. So, whether you’re a seasoned traveler or an occasional flyer, there’s a mileage credit card out there that’s perfect for you. Start exploring your options today and make your travels more rewarding!

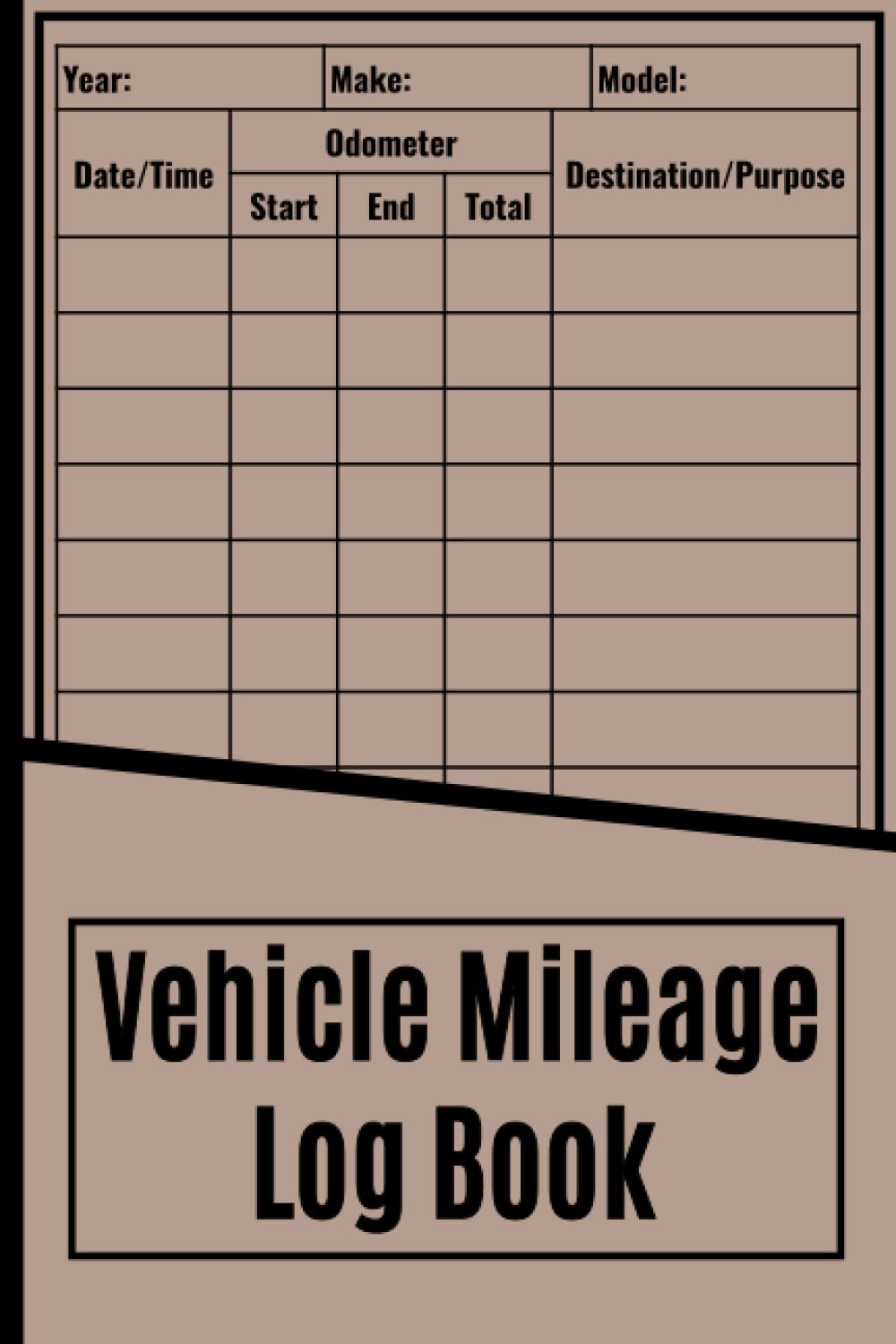

Vehicle Mileage Log Book:

Vehicle Mileage Log Book 6" x 9"

Stay organized and keep track of your vehicle expenses effortlessly with this Vehicle Mileage Log Book. Whether you're a business owner, freelancer, or simply need to monitor your personal mileage for tax deductions, this compact 6" x 9" logbook is the perfect tool to record your trips efficiently.

Key Features:

✅ Detailed Tracking: Includes space to log date, start & end mileage, purpose, destination, and total miles traveled.

✅ Easy-to-Use Layout: A well-structured format that ensures quick and hassle-free entries.

✅ Ideal for Business & Personal Use: Great for small business owners, independent contractors, gig workers, and self-employed professionals.

✅ Portable & Convenient Size: 6" x 9"—small enough to fit in your glove box or bag but spacious enough for clear record-keeping.

✅ Durable & Professional Design: Sleek, high-quality cover and sturdy pages for long-term use.

Perfect for IRS mileage tracking, tax deductions, business reimbursements, and fleet management, this Vehicle Mileage Log Book ensures you never miss an important entry. Stay organized, maximize your deductions, and take control of your vehicle expenses today! 🚗💼