Welcome to "GMC gourmet Restaurant," where we blend the worlds of culinary delight and automotive efficiency! In today’s article, we’ll explore the nuances of selecting vehicles with remarkable gas mileage, ensuring you not only enjoy fine dining but also save on fuel. Whether you're hitting the road for a weekend getaway or simply commuting, understanding which used cars offer the best gas mileage is essential for budget-conscious drivers.

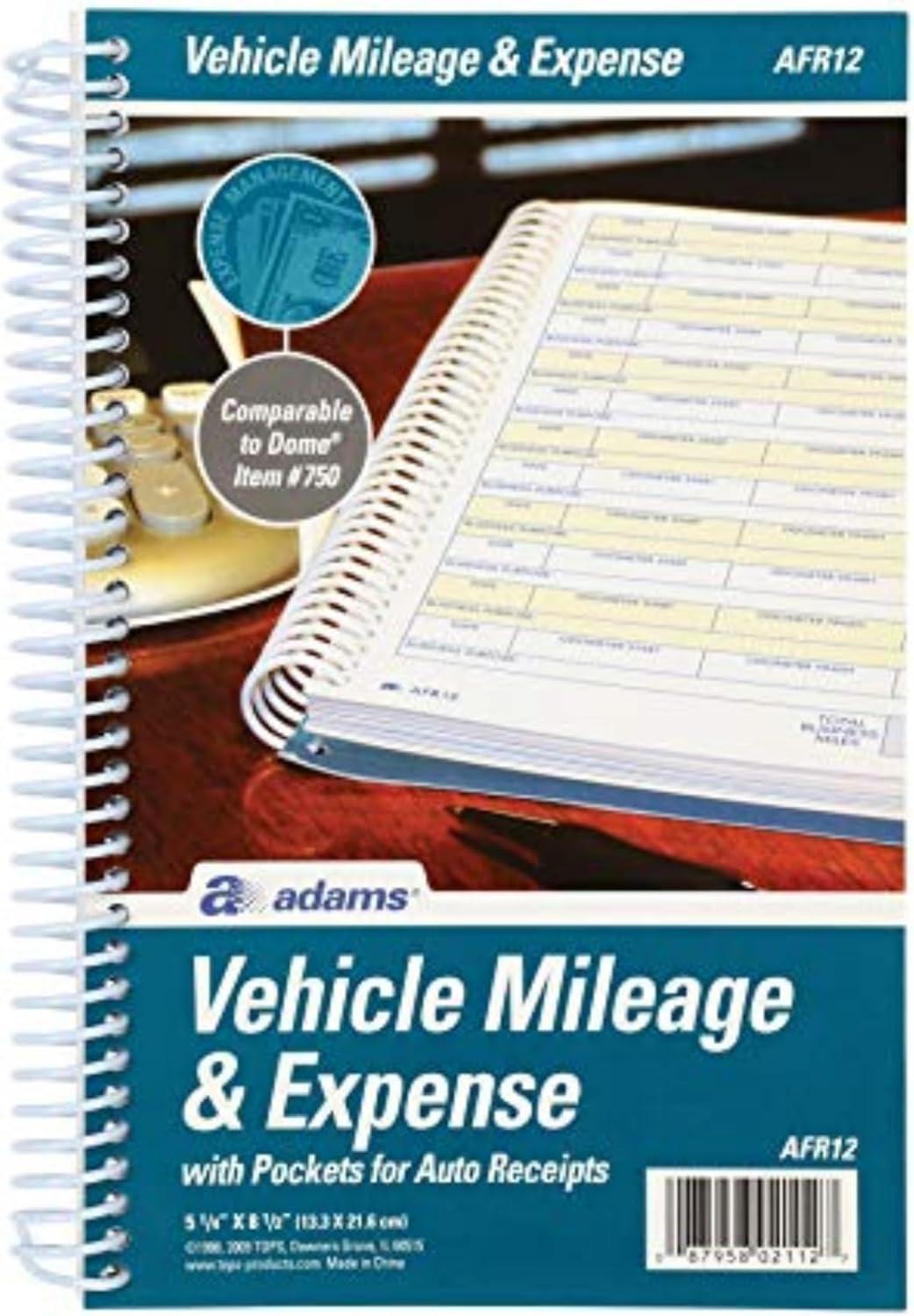

To keep track of your travel expenses seamlessly, we recommend the Adams ABFAFR12 Vehicle Mileage and Expense Journal. This handy,glove box-pleasant journal features 588 mileage entries and six receipt pockets,making it easy to log your trips and manage costs. With its compact spiral-bound design,you’ll always have your records close at hand. join us as we delve into the intersection of flavorful food and practical car ownership, ensuring you make informed choices at every turn!

Your Ultimate Ally for Tracking Vehicle Expenses

In the fast-paced world of small business, keeping track of vehicle expenses can feel like an uphill battle, especially come tax season. That's where your new best buddy steps in! This vehicle mileage and expense journal makes it a breeze to maintain detailed records of your daily car usage. With a whopping 588 entries available, you can jot down essential info without stressing over the details. The handy annual summary also allows you to quickly calculate your business use percentage—perfect for those who want to maximize deductions without getting buried under paper trails this April.

But it’s not just about tracking mileage; you’re also equipped with pages for maintenance logs, parking tolls, and even a place for receipts! No more scrambling for that oil change receipt or missing toll payment documentation. Plus, this journal fits snugly in your glove compartment, so it's always handy when you need it. Just remember,while it’s easy to whip out and fill in,some folks find that keeping up with daily entries requires a bit of diligence. But hey, the peace of mind and potential tax savings? Totally worth it!

- Requires daily entries for accurate tracking, which may feel burdensome for some users.

- Space limitations for notes on lengthy trips might be constraining for those with many details to document.

| Feature | Detail |

|---|---|

| Number of Entries | 588 Mileage Logs |

| Summary Pages | Annual summary page for monthly totals |

| Receipt Pockets | 6 pockets for organizing maintenance and toll receipts |

Getting your hands on this journal is as easy as clicking below! Don't miss out on the chance to simplify your vehicle expense tracking and save big during tax time.

Discover the Essential Features of the Adams Mileage Journal

When it comes to managing your business mileage, keeping accurate records can feel like a chore, but the Mileage Journal simplifies the task significantly. With the ability to log up to 588 entries, you can meticulously track your trips' dates, odometer readings, and purposes without any hassle. You'll appreciate the annual summary page, which makes it a breeze to calculate your vehicle's business-use percentage come tax time.Plus, it’s a compact size (5-1/4" x 8-1/2"), so you can easily fit it into your glove box, ensuring it’s always within reach when you need it.

One of the standout features here is the inclusion of 6 handy receipt pockets for maintenance, repairs, parking, and tolls—helping you keep everything organized for those deductible expenses. While this product offers a wealth of features, some users have shared a few frustrations. As a notable example,the limited space for notes on each entry can make it tough to jot down all necessary details,and some would love for it to be a bit more sturdy for their daily travels. Still, the overall functionality paired with practical design makes this journal an invaluable tool for any busy professional looking to maximize their deductions.

- Limited space for detailed notes on each entry

- Some users wish it was sturdier for daily use

| Feature | Detail |

|---|---|

| Mileage Entries | 588 logs for detailed tracking |

| Annual Summary page | Helps calculate business-use percentage easily |

| Receipt Pockets | 6 total pockets for organized expense tracking |

Making the best of your business-related car expenses has never been easier. With the Mileage Journal at your side, you're not just recording miles; you're setting yourself up for stress-free tax preparation. Take charge of your travel expenses today!

Real Users Share Their Experience with This Handy journal

###

If you’re tired of scrambling to remember your business mileage come tax time, you're not alone! Many users rave about the Adams Vehicle Mileage and Expense Journal for its compact design that fits right in your glove compartment, ensuring you always have it on hand. With 588 entries, you can easily jot down vital details like odometer readings and the purpose of each trip. One user found that it streamlined their record-keeping process, allowing them to focus on what truly matters—growing their business, not stressing over paperwork. Plus, the handy annual summary page means you’ll have calculations ready for those tricky percentages in no time!

Though, it’s not all sunshine and rainbows. A few users wished for more detailed prompts on how to maximize the use of all the receipt pockets, and some noted that the pages coudl be a bit fragile if not handled with care. Thankfully, the overall functionality and ease of use overshadow these minor quirks. With the ability to track maintenance and accumulate totals for parking and tolls, this journal is proving to be more than just a mileage tracker; it's an invaluable tool for any small business owner.

- Users find instruction on receipts management lacking.

- Pages can be a bit delicate; handle with care.

| Feature | Detail |

|---|---|

| entries | 588 mileage logs for detailed tracking |

| Size | 5-1/4" x 8-1/2",perfect for glove boxes |

| Receipt pockets | 6 total pockets for organized receipt storage |

Whether you’re a seasoned professional or just starting,the Adams Vehicle Mileage and Expense Journal is here to help you keep those meticulous records without any hassle. Don't let those tax deductions slip away—grab yours today!

Maximize Your Savings and Organization with practical Use Cases

When it comes to keeping your vehicle expenses organized, nothing beats having a solid way to track your mileage and expenses. The Vehicle Mileage and Expense Journal tackles this need head-on, offering a fantastic 588 entries to neatly capture every relevant detail from your business trips. You’ll find spaces to log the start and end odometer readings, the total miles traveled, and the specific purpose of each trip. Plus, an annual summary page lays it all out for you—making tax calculations a whole lot simpler.And let’s be real, when tax season rolls around, anything that helps streamline the process is a true lifesaver!

on top of its practicality, this journal is designed to fit perfectly in your glove compartment, ensuring you always have it on hand.It's got 6 handy pockets for receipts, allowing you to keep proof of expenses for maintenance, repairs, and those pesky tolls. Think of it as your personal assistant for documenting what can often be overlooked in the hustle and bustle of daily work life. Keeping accurate records isn’t just smart; it can lead to maximized deductions, putting more money back in your pocket! While the journal serves its purpose well, it does have a few minor downsides that are worth noting:

- Limited space for detailing larger or more complex expenses.

- Some users may find the physical size a bit cumbersome when carrying multiple items.

| Feature | Detail |

|---|---|

| Number of Entries | 588 mileage logs |

| Size | 5-1/4" x 8-1/2" |

| receipt Pockets | 6 pockets for receipts |

So if you're serious about maximizing your savings and keeping your vehicle records in line for tax time, this journal is a smart choice. Don’t wait—get your hands on this essential tool today!

Your Takeaway: Honest Insights and Recommendations for Everyday Use

When it comes to keeping your vehicle expenses in check, detailed records are your best friend. The mileage and expense journal is designed to simplify the tracking process, ensuring you never miss a deduction again come tax season. With an impressive 588 entries for documenting details like odometer readings, trip dates, and business purposes, you can capture every essential aspect of your business outings. Plus, the handy annual summary page allows you to quickly calculate your business-use percentage, making tax time a whole lot smoother. Forget fumbling through digital apps that might crash at the wrong moment; this pocket-sized gem fits right into your glove box, ready for immediate recording.

Of course,it’s not all sunshine and rainbows. A few users have noticed that the compact size, while convenient, might make it a bit cramped for extensive note-taking. Additionally, some have mentioned they'd love more diverse organizational features for long-term tracking beyond just mileage logs. But with its sturdy construction and six pockets for receipts, this journal remains a solid choice to keep your vehicle-related expenses well documented and easily accessible. if you're looking for a straightforward tool to help manage your business mileage accurately and efficiently, this journal could vrey well be what you need.

- Limited space for extensive note-taking on long trips.

- Some users would appreciate additional organizational features.

| Feature | Detail |

|---|---|

| Number of Entries | 588 Mileage Logs |

| Size | 5-1/4" x 8-1/2" inches |

| receipt Pockets | 6 total (for services, repairs, parking, and tolls) |

Don't miss out on making your tax preparation a breeze—get your hands on this essential journal today!

Pros & Cons

Pros of the Adams ABFAFR12 vehicle Mileage and Expense Journal

- Compact Size: at 5-1/4" x 8-1/2",it easily fits in your glove box.

- High Capacity: With 588 mileage entries, it can accommodate extensive tracking needs.

- Receipt Storage: Features 6 pockets designed to hold receipts, enhancing organization.

- Spiral Bound: The spiral binding allows for easy flipping of pages and stability while writing.

- Brand Reputation: Adams is known for producing reliable stationery products, enhancing trust in quality.

- Affordable Pricing: Offers good value for a dedicated expense tracking tool.

Cons of the Adams ABFAFR12 Vehicle Mileage and Expense Journal

- Limited Features: Primarily focused on mileage and expenses, lacking additional functionalities like budgeting tools.

- paper Quality: Some users may find the paper quality to be standard and not durable for heavy written use.

- Size Limitations: The size may not suit those who prefer a larger recording space for detailed notes.

- No Digital Backup: As a physical journal,it doesn't provide digital options for backup and swift reference.

If you're looking to streamline your expense tracking while on the road, consider this convenient and efficient journal.

Q&A

Question: What are the dimensions and format of the Adams ABFAFR12 vehicle mileage and Expense Journal?

Answer: The Adams ABFAFR12 Journal measures 5-1/4" x 8-1/2", making it compact enough to fit easily in your vehicle's glove box. It is indeed spiral-bound, allowing for easy access and cozy writing whether you're at the wheel or on the go.

Question: How many mileage entries can I record in this journal?

Answer: This journal provides space for up to 588 mileage entries. This ample capacity allows you to track your vehicle usage whether for personal trips, business purposes, or both, ensuring you have detailed records whenever you need them.

Question: Are there pockets for storing receipts in this mileage journal?

Answer: Yes, the journal includes 6 receipt pockets specifically designed for organizing and storing related receipts. This feature makes it convenient to keep all your mileage and expense documentation in one place, helping you stay organized for tax purposes or reimbursement requests.

question: What is the benefit of using a physical mileage journal instead of a digital app?

Answer: A physical mileage journal,like the Adams ABFAFR12,offers several benefits. It eliminates the need for electronics,making it accessible in all conditions,such as during long trips without service. It can be used without worrying about battery life or data connectivity. Additionally, some users find tangible writing more reliable and easier for record-keeping compared to apps.

Question: Is the paper quality suitable for long-term use?

Answer: Yes, the Adams mileage journal is made with durable paper that can withstand frequent use without tearing or fraying. This ensures that your entries remain legible over time, making it reliable for record-keeping, especially if you need to refer back to your entries for audits or tax preparation.

Question: Can this journal be used for tracking expenses other than vehicle mileage?

Answer: While the primary purpose of the Adams ABFAFR12 is to track vehicle mileage, the additional receipt pockets allow you to organize expenses related to trips, such as fuel, tolls, and maintenance. Therefore, it can certainly aid in tracking travel-related expenses making it a versatile tool for budgeting purposes.

Question: How can the journal assist me during tax season?

Answer: The Adams mileage journal simplifies the process of preparing your taxes by keeping a detailed log of both mileage and related expenses. Accurate records of your mileage can help maximize deductions for business use of a vehicle, and the organized receipt pockets ensure that you have all the necessary documentation readily available for tax preparations or potential audits.

Question: Is the journal user-friendly for anyone, nonetheless of experience with tracking expenses?

Answer: Absolutely! The layout of the Adams ABFAFR12 is straightforward and user-friendly. It is indeed designed to be intuitive, making it easy for anyone to start recording their mileage and expenses quickly, regardless of their previous experience with such logs. Simply fill in the required fields and keep track of your journeys efficiently.

Unleash Your True Potential

By now, you can see how leveraging a dedicated mileage and expense journal can transform your record-keeping experience—it not only simplifies your tax season but also helps maximize your deductions. With every entry, you gain peace of mind knowing that you’ve documented everything accurately, allowing you to focus on what truly matters: growing your business.

Ready to take control of your expenses? Dive into effortless organization and ensure you never miss a deductible again!

Buy Adams ABFAFR12 Vehicle Mileage and Expense Journal, 5-1/4" x 8-1/2", Fits the Glove Box, Spiral Bound, 588 Mileage Entries, 6 receipt Pockets,White Now

Buy Adams ABFAFR12 Vehicle Mileage and Expense Journal, 5-1/4" x 8-1/2", Fits the Glove Box, Spiral Bound, 588 Mileage Entries, 6 receipt Pockets,White Now