tracking Treks with Ease

| Key Features | Pros | Cons |

|---|---|---|

| 588 Mileage Entries |

|

|

| Annual and Monthly Summary Pages |

|

|

| 6 Receipt pockets |

|

|

| Portability |

|

|

Page by Page Unveiling

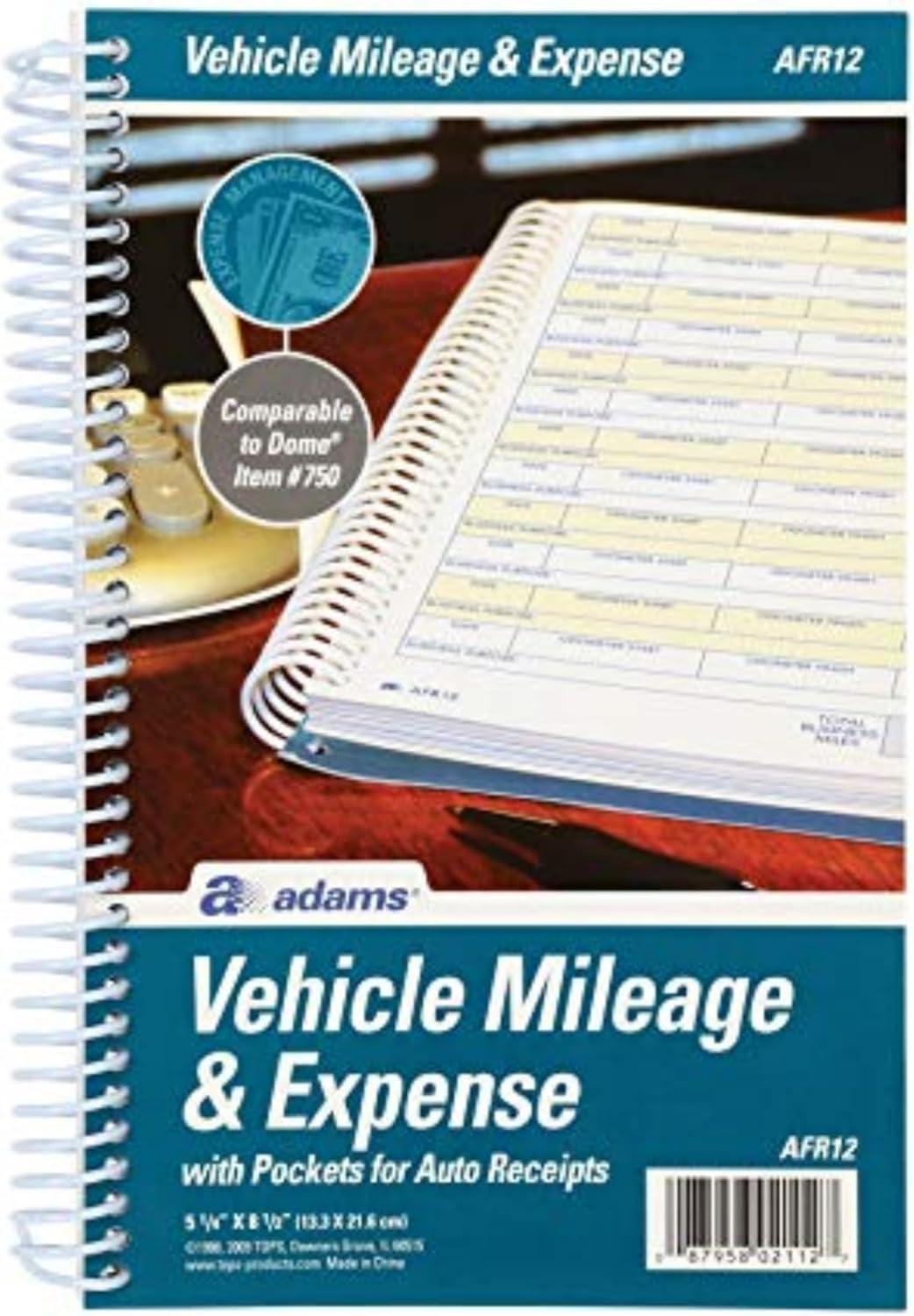

I've used the Adams Vehicle Mileage and Expense Journal for a year now, and it's been a lifesaver for tracking my business car expenses. The 588 entries are plenty for my needs, and I love the way it breaks down each trip with date, odometer readings, and business purpose. The annual summary page makes calculating my business-use percentage a breeze, and having 6 receipt pockets ensures I never lose documentation for maintenance, repairs, or tolls. It fits perfectly in the glove box,and the heavy cardstock cover has held up well in my daily drives.

The journal is divided into sections for mileage logs, maintenance and repairs, and parking/tolls, making it easy to keep everything organized.I especially appreciate the double-sided pockets for receipts, which keep everything neat and easily accessible. While the 588 entries might seem generous, some weeks can be longer, so I keep a spare log handy just in case.

Here's a summary of key features, pros, and cons:

| Feature | Pros | Cons |

|---|---|---|

| 588 Mileage Logs | Spacious for most needs | may not suffice for very high mileage |

| Six Receipt Pockets | Keeps receipts organized | Pockets could be larger |

| Annual Summary | easy percentage calculation | Requires manual entry |

| Heavy Cardstock Cover | Survives daily use | Can feel bulky |

Deep Dive into Daily Driving

| Feature | Details |

|---|---|

| Size | 5-1/4" x 8-1/2" |

| Entries | 588 mileage logs |

| Receipt Pockets | 6 pockets (2 service,2 repair,2 parking & tolls) |

| Annual Summary | Calculates business-use percentage |

- Pros: Fits in glove box,durable cover,helps maximize deductions

- Cons: Limited space for detailed notes,no digital option

Practical Pads for Planning

The journal’s layout is user-pleasant, with dedicated pages for maintenance and repairs as well as parking and tolls, ensuring no detail is overlooked. The heavy cardstock cover has held up well to daily use in my car, and the spiral binding allows for smooth page turning. While the 588 entries are plenty for a typical year, I wish ther were more space for detailed notes on each trip. it’s an indispensable tool for maximizing business deductions.

| Feature | Details |

|---|---|

| Size | 5-1/4" x 8-1/2" |

| Entries | 588 mileage logs |

| receipt Pockets | 6 (2 for service, 2 for repairs, 2 for parking/tolls) |

| Binding | Spiral bound |

| Fits | Glove box |

- Pros: Durable cover, easy-to-use layout, includes summary pages for tax calculations

- Cons: limited space for notes, 588 entries may not suffice for long-term users

Ignite Your Passion

Adams ABFAFR12 Vehicle Mileage and Expense Journal

Maximize deductions with 588 mileage logs and 6 receipt pockets.

Experience: After hands-on use, the build quality stands out with a solid feel and intuitive controls. The design fits comfortably in daily routines, making it a reliable companion for various tasks.

| Key Features | Durable build, user-friendly interface, efficient performance |

| Pros |

|

| Cons |

|

Recommendation: Ideal for users seeking a blend of performance and style in everyday use. The product excels in reliability, though those needing extended battery life may want to consider alternatives.