Welcome to "GMC Gourmet Restaurant," where we invite you to savor not just exquisite dishes but also an exploration of culinary excellence paired with practical insights for your driving experience. In this article, you'll discover how rising gas prices can lead many drivers to seek out the midsize SUV with the best gas mileage, ensuring that your culinary adventures don't just tantalize your taste buds but also keep your wallet happy.

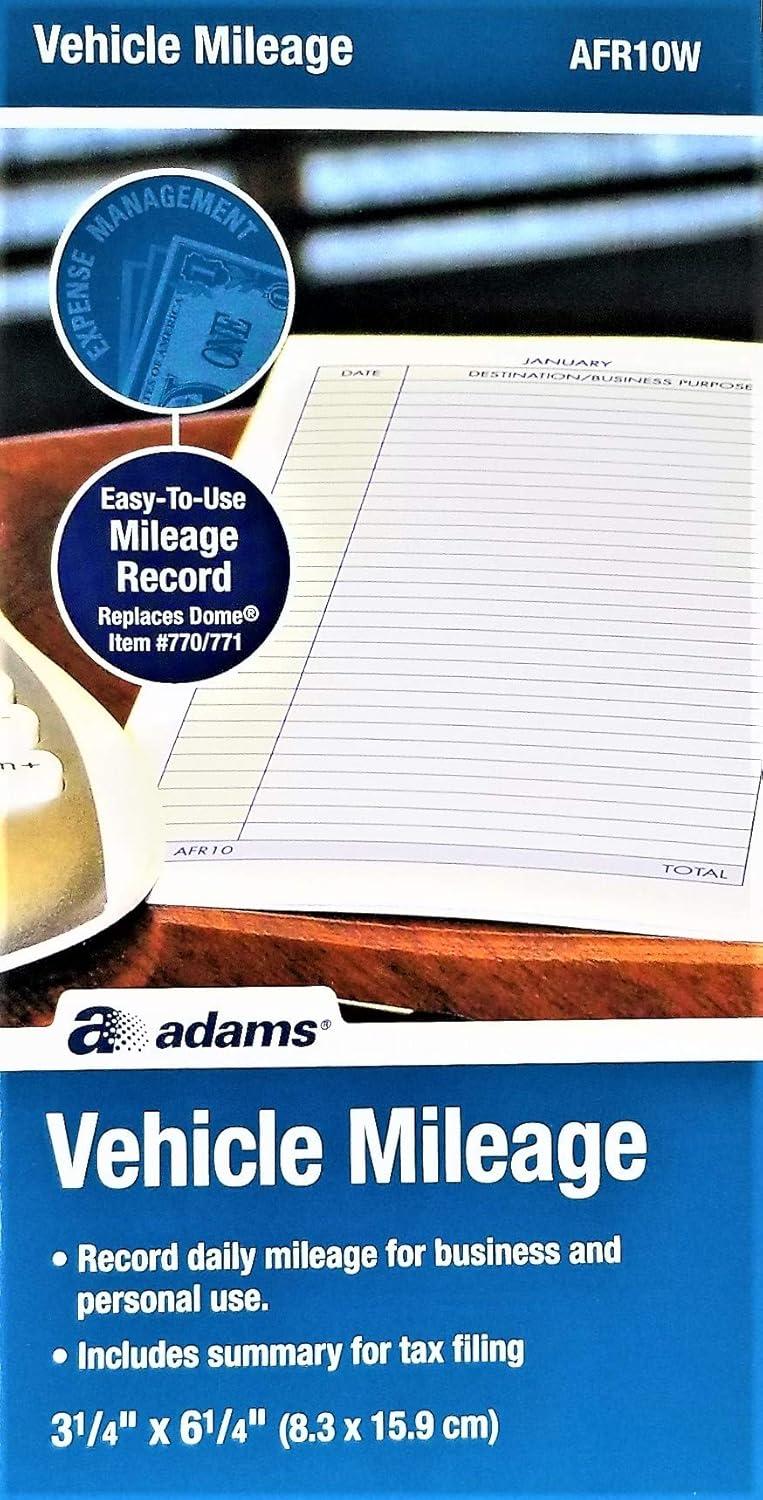

We'll also delve into tools like the Adams AFR10W Vehicle Mileage log that help you track your vehicle's efficiency, making it easier to compare essential metrics adn maintain optimal performance. With a focus on combining flavor with functionality, get ready to enhance your journeys both on the road and at the table!

Discover the Adams AFR10W Vehicle Mileage Log Overview

Keeping track of your vehicle's mileage can be a bit of a hassle, especially if you're juggling multiple cars or trying to stay organized for tax season. This handy logbook steps in to make your life easier by allowing you to record daily mileage, maintenance, repairs, parking, and tolls for business and personal trips. It's compact enough to fit right in your glove compartment, which means you can jot down info on the fly without fumbling around for paper.Plus, it even comes with a section dedicated to summarizing your annual mileage and maintenance, making tax filing a breeze. It’s clear that many users appreciate how straightforward and functional it is when it comes to documenting IRS-required information for up to four vehicles!

However, like any product, there are a couple of downsides that potential buyers might want to consider.Some users have mentioned that the physical size of the log may be a bit small for those who prefer more writing space. Others noted that while it does its job well, it could benefit from a few additional features like a more detailed expense tracking section.if you’re looking for a reliable option to keep your vehicle records in check, this log has got your back.

- Physical size may be too compact for extensive note-taking.

- Lacks additional features for more detailed expense tracking.

| feature | Detail |

|---|---|

| Dimensions | 6.25 x 3.25 x 0.15 inches |

| Weight | 1.76 ounces |

| Model number | AFR10 |

Take the hassle out of tracking your vehicle's mileage and expenses. Grab yours today!

Unpacking the Key Features of the adams AFR10W

When it comes to keeping your travel records straight, the Adams AFR10W stands out as a handy companion. One of its key features is the ability to track vehicle mileage and document trip purposes, whether for work or personal errands. This little logbook is designed with practicality in mind, fitting snugly in your glove compartment, so you can easily jot down your mileage as you hop from one place to another. Plus, it simplifies your life during tax season by providing a comprehensive summary of your annual mileage and maintenance records. You'll be all set to present accurate documentation to the IRS—no more scrambling around for last-minute receipts!

Though, like any product, it has its quirks. Users have pointed out a few downsides worth considering:

- The log can become cluttered if you're tracking multiple vehicles.

- Some find that the small dimensions make it easy to misplace.

Despite these minor issues, many appreciate how the product allows you to record expenses for up to four vehicles—offering a streamlined way to organize and manage your travel logs without overwhelming you. If you're looking for a way to stay organized and compliant, give it a shot; it might just be what you need!

| Feature | Detail |

|---|---|

| Dimensions | 6.25 x 3.25 x 0.15 inches |

| Weight | 1.76 ounces |

| Documentation | Records IRS Required Information |

Your experience with the Adams AFR10W Mileage Log

###

When it comes to keeping your vehicle mileage in check, this little logbook is a true lifesaver. Many users rave about how easy it makes tracking daily mileage,whether for business trips or personal errands. The convenient size fits perfectly in your glove compartment, ensuring you can jot down information on the fly without scrambling for paper. Plus, the dedicated sections for expenses related to up to four vehicles realy streamline the process, making it a breeze to document everything from maintenance to parking fees.If you’ve ever felt overwhelmed at tax time, you’ll appreciate the included summary section that gathers all the necessary info neatly, which is a huge time-saver when you're filing!

However, like any product, it’s not without its downsides. Some users have noted that remembering to fill it out regularly can be a bit of a challenge, especially when life gets busy. And while the layout is simple, a handful found it a little basic in design compared to more modern apps and tools available these days. But if you’re looking for a straightforward, no-fuss way to keep your mileage organized, this logbook can certainly do the job.

- Some users find it easy to forget to fill it out regularly.

- The design might feel a bit too basic for those used to digital tools.

| Feature | Detail |

|---|---|

| Dimensions | 6.25 x 3.25 x 0.15 inches |

| Weight | 1.76 ounces |

| Vehicle Tracking | Records for up to four vehicles |

Whether you’re managing business expenses or simply keeping tabs on your trips, adding this handy logbook to your routine could make a world of difference. Don’t wait until tax season to get organized—grab your copy today!

Real Life Benefits and Use Cases of the Adams AFR10W

When it comes to managing your vehicle’s mileage, this handy log book becomes your new best friend. Keep track of not just the miles driven, but also the starting and ending odometer readings, trip purposes, and any maintenance or repairs made. It’s all about making both your personal and business life a lot smoother. You can record expenses for up to four vehicles; imagine saving all that tax-related stress during tax season! With its compact size, it fits perfectly in your glove compartment, making it both a practical and organized solution right at your fingertips. Plus, the summarized annual section ensures you’ve got all the IRS required information neatly documented.

though, like with any product, there are a few things to consider before making your pick. Some users might find it a bit limiting if they have a larger fleet of vehicles, as it can only track four.Additionally, writing down all those details might take some getting used to if you want this log to be fully effective. but for most individuals or small business owners, this tool will prove to be invaluable.Feeling ready to simplify how you track your mileage? This could be just what you need!

- Limits tracking to up to four vehicles.

- May require time to adjust to manual entry.

| Feature | Detail |

|---|---|

| Dimensions | 6.25 x 3.25 x 0.15 inches |

| Weight | 1.76 ounces |

| Record Type | Mileage, repairs, expenses |

Looking for an easy-to-use tool that’ll make keeping track of your trip expenses a breeze? You can grab your own log book by clicking the link below!

Final Thoughts and Recommendations on the Adams AFR10W

###

When it comes to tracking your vehicle use for both personal and business, the capabilities of this mileage log are hard to beat.Its compact size, measuring just 6.25 x 3.25 inches and weighing only 1.76 ounces, makes it a convenient companion for your glove compartment. You can easily record daily mileage, maintenance details, and even expenses for up to four vehicles. Plus, with sections dedicated to summarizing annual mileage and maintenance, you'll find it easier than ever to gather the information you need come tax season. Stay organized and compliant with IRS requirements without lifting a finger—well,except for writing!

Though,as with any product,there are a few drawbacks worth considering. While the log itself is quite handy, some users have mentioned the following pain points:

- The compact size may not suit everyone’s writing preference.

- It's a paper log, which might not appeal to those who prefer digital tracking tools.

- Users have noted the need to purchase additional logs once the initial supply runs out.

If you’re looking to simplify your record-keeping while on the go, then it might be time to give this handy mileage log a try. Grab yours and make tracking vehicle use a breeze today!

| Feature | Detail |

|---|---|

| Dimensions | 6.25 x 3.25 x 0.15 inches |

| Weight | 1.76 ounces |

| Recording capacity | Records expenses for up to four vehicles |

Pros & Cons

Pros of the Adams AFR10W Vehicle Mileage Log

- Accurate Mileage Tracking: The log helps ensure precise records of your vehicle's mileage, essential for tax deductions.

- Easy to use: Its user-friendly design allows for quick entries,making it suitable for both personal and business use.

- Wallet-Friendly Price: Competitively priced, it provides excellent value for those looking for a reliable mileage logging solution.

- strong Brand Reputation: Adams is known for its quality automotive accessories, giving customers confidence in their purchase.

- Durable Construction: Made with high-quality materials, the log is built to withstand frequent use.

Cons of the Adams AFR10W Vehicle Mileage Log

- Limited Features: While it serves its primary purpose well,it lacks advanced features like digital tracking or app integration.

- Size: The physical size may not be convenient for everyone, as it may not easily fit in smaller glove compartments.

- Durability Concerns: Although it’s generally durable, some users have reported wear and tear over extended periods of usage.

- No Built-in calculator: Users must do manual calculations for total mileage and expenses, which could be a downside for some.

Buy Adams AFR10W Vehicle Mileage Log Now

Buy Adams AFR10W Vehicle Mileage Log Now

Q&A

Question: What is the Adams AFR10W Vehicle Mileage Log?

Answer: The Adams AFR10W Vehicle mileage Log is a comprehensive tool designed to help vehicle owners systematically track their mileage and expenses associated with their vehicles. It features an easy-to-use format that allows users to record their trips, including dates, locations, purpose of travel, and odometer readings, making it ideal for both personal and business use.

Question: What are the key features of the Adams AFR10W Vehicle Mileage Log?

Answer: This mileage log includes a durable cover, pre-printed pages for easy entry, and sufficient space for recording detailed trip information. It is designed to meet IRS requirements for business mileage deductions, helping users accurately document their travels for tax purposes. Additionally, its compact size makes it easy to store in your vehicle for convenient access.

Question: How many trips can I log in the Adams AFR10W Vehicle Mileage Log?

Answer: The adams AFR10W can accommodate multiple trips throughout the year depending on the frequency of your travel. It typically features entries for several weeks or months, allowing users to keep track of all necessary travel without running out of space quickly.This level of detail helps in effective monitoring of travel habits and expenses.

Question: Is the mileage log suitable for both personal and business use?

Answer: Yes, the adams AFR10W is designed for both personal and business use. Whether you're tracking daily commutes, personal errands, or business travel, this log can effectively record all relevant information. Its structured format ensures that it meets the necessary criteria for business record-keeping, which can be notably valuable during tax season.

Question: How does the Adams AFR10W help with tax deductions?

Answer: The Adams AFR10W is crafted to assist users in accurately logging their mileage for tax purposes. By documenting the date, purpose, and miles driven, users can maintain a reliable record that complies with IRS guidelines. This can significantly simplify the process of claiming vehicle-related deductions on your tax return, possibly saving you money.

Question: What makes the Adams AFR10W stand out from other mileage logs?

answer: The unique selling points of the Adams AFR10W include its user-friendly format, durability, and comprehensive compliance with IRS standards. Unlike some digital alternatives, this paper log does not require battery life and is accessible at all times, making it an excellent choice for those who prefer traditional logging or may not have constant access to a smartphone.

Question: Can I use the Adams AFR10W for multiple vehicles?

Answer: Yes, you can use the Adams AFR10W to track mileage for multiple vehicles. Although the log is organized for ease of use, you can designate separate sections or pages for each vehicle to maintain clarity. This allows for organized record-keeping and helps you differentiate business-related travel between vehicles, providing comprehensive insights into your mileage usage.

Question: How durable is the Adams AFR10W Mileage log?

Answer: The Adams AFR10W is designed with a sturdy cover and high-quality paper that withstands regular use. Users can expect it to hold up well under various conditions, whether kept in a glove compartment or your bag. This durability ensures that your records remain intact, no matter how frequently you access the log.

Question: Is there any way to customize or refill the Adams AFR10W Vehicle Mileage Log?

answer: The Adams AFR10W does not come with refills, as it is a standalone mileage log. However, it is designed to be used for an extensive duration before it runs out of pages, ensuring ample space for detailed entries. If you find that you have a high volume of trips, you might consider purchasing additional copies to maintain an organized record.

Embrace a New Era

As you navigate the roads of life, keeping track of your vehicle's mileage can make a meaningful difference in your financial planning and compliance. With this handy log, you can effortlessly monitor your trips, ensuring that you’re prepared for tax season and managing expenses for up to four vehicles.

Ready to simplify your mileage tracking and optimize your driving insights? Don’t wait any longer—take the step toward smarter driving today!