Welcome to our exploration of GMC reviews, where we dive deep into the world of GMC vehicles wiht a focus on their fuel efficiency. If you’re searching for cars that deliver extraordinary gas mileage without the hybrid tag, you’re in the right place. We’ll help you understand how GMC models stack up in terms of performance, comfort, and sustainability, ensuring you make an informed choice that fits your lifestyle.

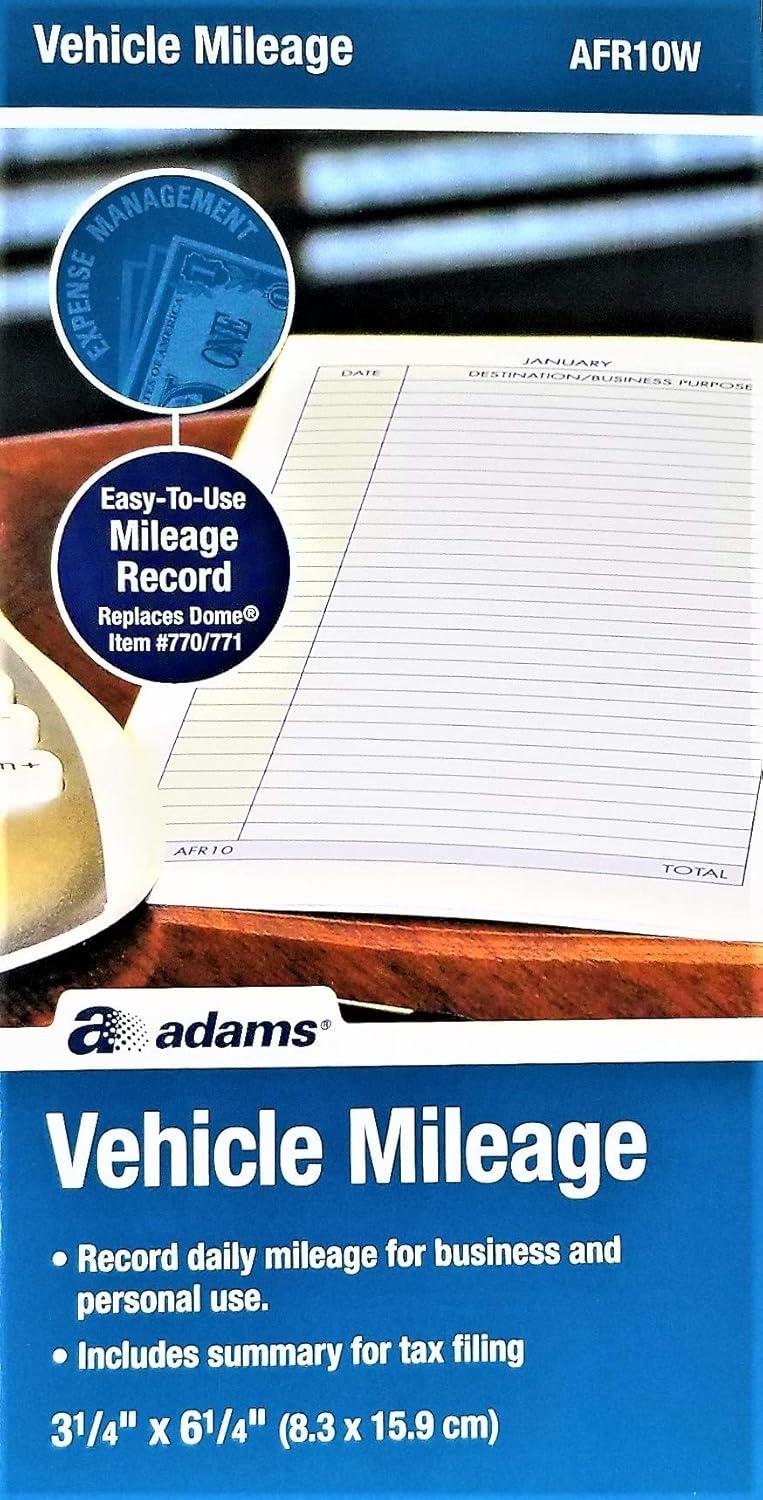

In this article, we'll also introduce useful tools like the adams AFR10W Vehicle Mileage Log, perfect for tracking your fuel consumption and making smarter driving decisions. Join us as we uncover essential insights and practical tips that will empower you to find the best GMC for your needs while maximizing your savings at the pump. Whether you’re a seasoned GMC enthusiast or a curious newcomer, there’s something here for everyone!

Getting Started with the Adams AFR10W Vehicle Mileage Log

When you’re juggling business meetings and family trips,keeping track of your vehicle mileage can feel like a daunting task. Fortunately, this compact mileage log is here to simplify that for you.With a lightweight design that easily fits in your glove compartment, you can quickly jot down your trips whether they're for work or leisure. One of the standout features is its ability to track expenses for up to four vehicles, making it a fantastic option for families or small business owners. Plus, it documents all the IRS-required facts—talk about a win during tax season! If organization is your thing, you’ll appreciate the included section for summarizing your annual mileage and maintenance records.

however, like anything, it's not without its quirks. Some users have expressed that the size might not be ideal for everyone, as it can be a bit small for extensive note-taking. Additionally, while it's efficient, it may not provide the digital functionality that some tech-savvy individuals prefer. But if you’re simple and straightforward in your record-keeping, you’ll likely find this log just what you need. Here’s a quick rundown of some points to consider:

- Size may feel cramped for detailed notes.

- Lacks modern digital elements.

| Feature | Detail |

|---|---|

| Dimensions | 6.25 x 3.25 x 0.15 inches |

| Weight | 1.76 ounces |

| vehicle Tracking | Up to four vehicles |

So, if you’re ready to streamline your mileage tracking and make tax filing a breeze, this log may be just the tool you need. Why not take a closer look and grab one for yourself?

Exploring the Key Features that Enhance Your Tracking Experience

When it comes to keeping your vehicle-related expenses in check, this handy tool has got your back! It's designed with versatility in mind, allowing you to seamlessly record not just your daily mileage, but also document repairs, maintenance, and even parking and toll fees. Whether you're tracking expenses for business trips or personal adventures, the organized structure helps you stay on top of everything. Plus, with the ability to manage the records for up to four vehicles, you won’t ever have to worry about mixing things up. The compact size makes it easy to slip into your glove compartment, ensuring you always have it at arm's reach whenever you need to jot something down.One of the standout features is its informative summary section,which is a lifesaver come tax season. It collects all those important details to make filing a breeze, fulfilling IRS requirements with minimal stress. However, there are a couple of points to consider. While it offers great functionality, some users felt that it could benefit from a more user-amiable layout.Additionally, the lack of a digital companion app may be a downside for those who prefer tech-based tracking. this product is perfect for anyone who values convenience and thoroughness in mileage tracking.

- Some users found the layout could be improved for ease of use.

- No digital app is available, which may not appeal to tech-savvy individuals.

| Feature | Detail |

|---|---|

| Record Daily Mileage | Capture daily trips for clarity and accuracy. |

| Expense Tracking | Document repairs,parking,and toll expenses. |

| Multi-Vehicle Support | Manage up to four vehicles in one convenient log. |

If you want to take control of your vehicle expenses and make tax time less of a headache, don’t miss out on this efficient mileage tracker. Grab yours today and simplify your tracking experience!

Your Journey with the Adams AFR10W: User Experiences unveiled

Your journey with the mileage tracker starts with its easily accessible design, perfect for storing right in your glove compartment. Users rave about how convenient this tool is for keeping tabs on both personal and business journeys. whether you’re calculating distance for that upcoming tax season or simply keeping track of trips to the grocery store, this little gem documents everything in a breeze. Reviewers particularly appreciate the clear layout, which helps them stay organized by recording daily mileage, maintenance, and even pesky parking fees, making it sound like a personal assistant dedicated to your vehicle's needs.

however, no product is without its quirks. Some users have found that while the tracker does an excellent job of summarizing mileage and expenses, it lacks a bit in user-friendliness, especially for first-timers. There have also been mentions that the small size can be a double-edged sword; while it fits snugly in your compartment, it can be easy to misplace if you're not careful. Here's a quick look at a few common downers shared by users:

- Overwhelming for new users due to extensive features.

- Small size makes it prone to being misplaced.

| Feature | Detail |

|---|---|

| Dimensions | 6.25 x 3.25 x 0.15 inches |

| Weight | 1.76 ounces |

| Vehicle Tracking | Records expenses for up to four vehicles |

if you’re looking for a reliable way to keep your vehicle documentation in check, this could be just what you need. Don’t miss the possibility to simplify your mileage and expense tracking – give it a try!

Unlocking the Benefits and Practical Use Cases for Everyday Drivers

When it comes to tracking vehicle mileage for business or personal use, having a reliable solution can really make your life easier. This mileage log is a solid option, allowing you to easily record daily vehicle mileage, maintenance, repairs, and even your expenses for up to four vehicles. It’s compact enough to fit perfectly in your glove compartment, which means you can access it whenever you need! With sections specifically designed to summarize your annual mileage and maintenance, this log not only keeps you organized, but it also takes the headache out of tax season by documenting IRS-required information—what’s not to love about that?

However, there are a couple of things you might find a bit tricky. Some users have expressed that the log could benefit from a more user-friendly layout for quicker entries. Additionally, while it serves as a great tool for tracking mileage, it doesn’t include reminders for regular maintenance, which can lead to missed service appointments. it's a handy tool, but there’s definitely room for improvement.

- The layout could be more user-friendly for quicker entries.

- it does not include reminders for regular maintenance, perhaps leading to missed service appointments.

| Feature | Detail |

|---|---|

| Dimensions | 6.25 x 3.25 x 0.15 inches |

| Weight | 1.76 ounces |

| Vehicle Tracking | Record mileage and expenses for up to four vehicles |

If you’re looking for an efficient way to manage your vehicle records, consider giving this mileage log a try. It makes organizing your travel easier and more straightforward, plus it can save you time during tax season! To grab yours, click the button below:

Final Thoughts and Recommendations for your mileage Logging Needs

When it comes to keeping your mileage organized, this handy little logbook really shines.It empowers you to record daily vehicle mileage, document maintenance, and even track expenses for up to four vehicles, making it a perfect companion for both business and personal use. The added bonus of being able to summarize your annual mileage and repairs is a lifesaver during tax season. You’ll appreciate how perfectly it fits in your glove compartment,ensuring it’s always on hand when needed. That’s right—no more fumbling around or digging through receipts when tax filing time rolls around!

Of course, like any product, it's not without a few quirks. Some users have mentioned challenges with finding the right spot for documenting their details or occasionally wishing it had more space for notes. Also, the size, while convenient, might limit the amount of info you can jot down for those longer trips. But if you're looking for a straightforward tool to simplify mileage logging and keep everything in check, this is a solid pick for you.

- Limited space for detailed notes on long trips.

- Some users find it tough to locate the ideal section for recording specific expenses.

| Feature | Detail |

|---|---|

| Dimensions | 6.25 x 3.25 x 0.15 inches |

| Weight | 1.76 ounces |

| Recording Capacity | Expenses for up to four vehicles |

Ready to streamline your mileage tracking? Grab your own copy and take the stress out of documenting your journeys!

Pros & Cons

Pros of Adams AFR10W Vehicle Mileage Log

- Product Performance: The mileage log is designed for accuracy, ensuring reliable tracking of vehicle usage.

- Ease of Use: Simple layout makes it user-friendly, suitable for both personal and professional use.

- compact Size: Its portable design fits easily in glove compartments or bags, making it accessible at all times.

- Affordability: Competitively priced without compromising on quality, offering great value.

- Brand Reputation: Adams is known for producing high-quality automotive products, ensuring trust in their mileage log.

Cons of Adams AFR10W Vehicle Mileage Log

- Durability Concerns: Some users report wear and tear over time, particularly with frequent use.

- Limited Features: Lacks advanced tracking options or digital integration that some competitors offer.

- Price Point: While affordable, it may still be considered slightly higher for budget-conscious consumers.

- Manual Updates: Requires manual entry of information, which might potentially be inconvenient for some users.

For those interested in an efficient and reliable vehicle mileage log, consider the Adams AFR10W.

Buy Adams AFR10W Vehicle Mileage Log Now

Buy Adams AFR10W Vehicle Mileage Log Now

Q&A

Question: What is the Adams AFR10W Vehicle Mileage Log?

Answer: The Adams AFR10W Vehicle Mileage Log is a durable,high-quality logbook designed to help you efficiently track your vehicle's mileage for business or personal purposes. It features pre-printed columns that guide you in recording crucial details such as date, destination, purpose of trip, and odometer readings, ensuring that your records are organized and easy to understand.

Question: How do I use the mileage log effectively?

Answer: To use the mileage log effectively, simply fill in the date of each trip, the destination, the purpose of the trip, starting and ending odometer readings, and any relevant notes. To ensure accuracy, it's advisable to fill in the log immediately after each trip, as this reduces the chance of forgetting details later. this logbook is perfect for professionals who need to provide proof of mileage for tax deductions or reimbursements.

Question: Is the mileage log durable and suitable for daily use?

Answer: Yes, the Adams AFR10W Vehicle Mileage Log is specifically designed for durability. It features a sturdy cover that can withstand daily use in various environments,whether it’s in a vehicle or carried in a bag. The pages are also made of high-quality paper, ensuring that they remain intact and legible over time, even with frequent handling.

Question: Can I use this logbook for multiple vehicles?

Answer: Absolutely! the Adams AFR10W allows you to track mileage for multiple vehicles.You can dedicate separate sections or entries for each vehicle and easily keep records organized.This feature is beneficial for businesses with a fleet of vehicles or individuals with more then one car.

Question: Does it meet IRS requirements for mileage tracking?

Answer: Yes, the Adams AFR10W Vehicle Mileage Log complies with IRS requirements for tracking business mileage.By using this logbook, you can provide the necessary documentation for your mileage deductions, including detailed records of trip purpose and mileage. This makes it a reliable tool for those seeking to maximize their tax deductions.

Question: How many entries does the logbook contain?

Answer: The Adams AFR10W Vehicle Mileage Log contains enough entry pages to last for an entire year,allowing users to conveniently track numerous trips without needing to switch logbooks often. Each page is designed with sufficient space for multiple entries while providing a clear layout for easy reading and filling.

Question: Is the logbook refillable once I run out of pages?

Answer: Sadly, the Adams AFR10W Vehicle Mileage Log is not refillable. Though, users can purchase additional logbooks as needed.This ensures that you can always have a dedicated vehicle mileage log at hand to maintain your records efficiently.

Question: Are there any digital alternatives to this logbook?

Answer: While there are digital apps available for mileage tracking, many users prefer the simplicity and reliability of a physical logbook like the Adams AFR10W. Unlike digital options, a physical logbook does not require battery life, internet access, or updates, making it handy for quick, on-the-go recordings without distractions.

Question: Can I use this logbook for personal trips as well as business trips?

Answer: Yes,you can use the Adams AFR10W Vehicle Mileage Log for personal trips in addition to business trips. Keeping records of personal mileage can be useful for personal budgeting or mileage reimbursement scenarios.Just ensure that you separate entries according to their respective purposes for clarity and accuracy.

Ignite Your Passion

As you navigate the daily demands of managing your vehicle, keeping track of mileage and expenses can feel overwhelming.The right tool can bring clarity and streamline your record-keeping considerably. With its compact design and user-friendly features, this mileage log is not just a practical addition to your glove compartment—it’s the key to ensuring you stay organized and prepared come tax season.Ready to take control of your vehicle expenses? Make your mileage tracking a breeze and simplify your life today.