Overview of the 12 Pack FinancialрганичествоДокументation

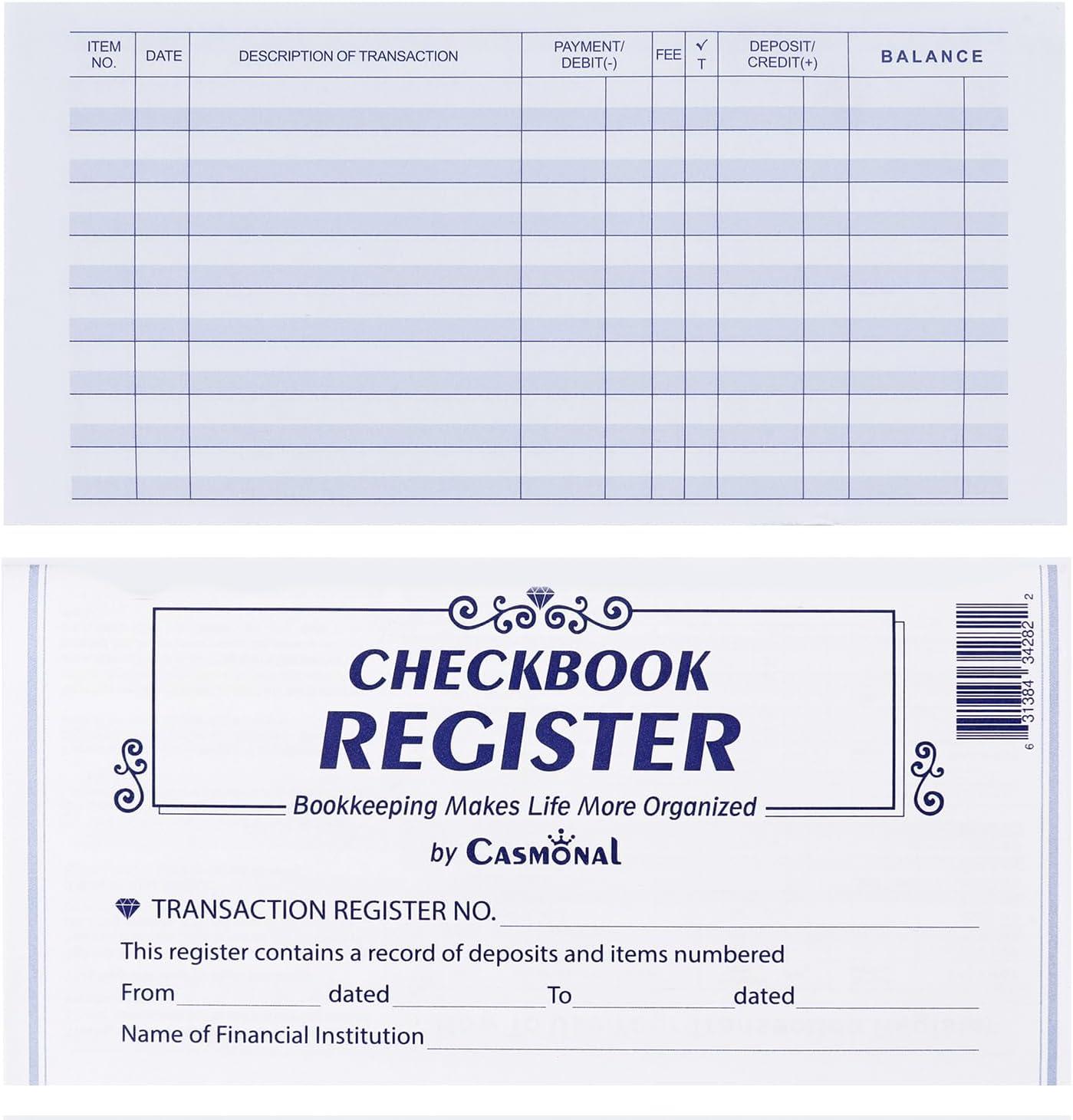

The 12 Pack Checkbook Register is designed for effortless financial management, featuring clear pages with 17 lines each for tracking withdrawals. The check register simplifies payments and deposits with columns for item numbers,transactions,and balances,making it ideal for both personal and small business use. The compact 6x3 inches size is perfect for on-the-go use, while the stylish 24/25/26 calendar from 2024 to 2026 helps guide your financial journey. The bold layout and spacious rows provide a comfortable writing experience, ensuring you stay on top of your finances without risk of overdrafts.

These transaction registers are multifunctional, helping you monitor balances, budget precisely, and gain insight into spending patterns.The included leather checkbook cover, pen holder, PVC divider, and elastic band make organization a breeze. Whether you're managing personal finances or small business accounts, this tool simplifies the process, making financial tracking simple and clear. The compact design ensures you can keep your finances in order wherever you go.

Here is a summary of key features,pros,and cons:

| Feature | Pros | Cons |

|---|---|---|

| 12-Pack checkbook register |

|

|

| 24/25/26 Calendar |

|

|

| Additional Features |

|

|

Our experience with the Checkbook Registers and Calendars

I've been using the Casmonal checkbook register for personal and work finances, and it's a game-changer. The 12-pack includes check registers, transaction registers, accounting ledger books, and checking account register books, all designed to simplify financial management. With clear pages featuring bold layouts and spacious rows, tracking account withdrawals is effortless. The columns for item numbers, transactions, and balances make it perfect for both personal and small business use.The elastic band and stylish 24/25/26 calendar (2024-2026) add convenience for on-the-go financial tracking.

The registers help me remember automatic deductions,avoid overdraft risks,and gain insight into spending patterns. It's lightweight and portable,fitting easily in my bag for quick references. The organization and clarity have improved my financial monitoring, making budgeting and goal-setting more straightforward. Though, some pages could be thicker for better durability, and the pen holder could be more robust for frequent use.

Here’s a summary of key features:

| Feature | Pros | Cons |

|---|---|---|

| 12-pack variety | Multiple uses for personal/business | Limited to paper-based tracking |

| Compact design | portable and lightweight | Pages could be thicker |

| Calendar (2024-2026) | Helps track financial goals | Paper-based,prone to loss |

| Layout | Clear rows and columns | Pen holder could be better |

Detailed Features and Design Considerations

I've found the 12 pack Checkbook Register to be incredibly useful for both personal and work use. The check register books are designed to help simplify financial management by making it easy to remember automatic deductions, avoid overdraft risks, and gain insights into spending patterns.Each transaction register features clear pages with 17 lines, bold layouts, and spacious rows and columns for a comfortable writing experience. The compact size (6x3 inches) makes it perfect for on-the-go financial tracking,and the included 24/25/26 calendars (2024-2026) add a helpful organizational touch.These registers are geared towards tracking payments and deposits with columns for item numbers, transactions, and balances. Whether you're managing personal finances or small business accounts,the checkbook registers provide a clear and concise way to monitor balances,budget precisely,and work towards financial goals. The durable, sturdy design ensures that the books hold up well over time, while the elastic band keeps everything secure.

One of the standout features is how these registers help users dodge overdraft risks and stay on top of their financial journey.The combination of financial instruments and a stylish calendar makes it easy to stay organized year-round. While the space is somewhat limited, the design optimizes the available area for efficiency. it’s a convenient and reliable tool for anyone looking to simplify their financial tracking.

| Feature | Pros | Cons |

|---|---|---|

| 12 Pack Checkbook Register |

|

|

Practical Insights for Personal and Professional Use

I've found that the 12 Pack Checkbook Register is incredibly useful for both personal and work financial tracking. The check register books allow me to easily monitor payments and deposits, with clear columns for item numbers, transactions, and balances. The bold layout and spacious rows provide a comfortable writing experience, making it simple to track account withdrawals and remember automatic deductions. It's especially helpful for avoiding overdraft risks and gaining insight into spending patterns.

The transaction registers are small and portable, fitting perfectly in my bag for on-the-go financial monitoring. Equipped with a stylish calendar from 2024 to 2026, it helps me stay organized and focused on my financial goals. Whether I'm managing personal finances or handling small business accounts, this tool simplifies the process and makes financial success more achievable.

| Feature | Pros | Cons |

|---|---|---|

| Checkbook Register | Lots of space for transactions, clear layout | Can be bulky for some |

| transaction Registers | Compact and portable, easy to carry | Pages may wear out quickly with heavy use |

| Calendar | covers three years, stays organized | Smaller print for older users |

Our Recommendations forFinancial Management

These account books have transformed how I manage my personal and small business finances. The 12 Pack Checkbook Register and Check Register Books are perfect for tracking payments and deposits, with clear columns for item numbers, transactions, and balances. They simplify monitoring with their 17 lines per page and bold layout, making it easy to record account withdrawals. The Transaction Registers and Accounting Ledger Books offer a comprehensive solution for both personal and small business use, helping me stay on top of my budget and avoid overdraft risks. Additionally, the Checking Account Register Books provide a convenient way to track automatic deductions and gain insight into my spending patterns. The 24/25/26 Calendars integrated into these books are a valuable added feature, keeping me organized and focused on my financial goals. The 6x3 inches size makes them portable and ideal for on-the-go financial tracking, while the leather cover and elastic band ensure durability and easy reference.

| Feature | Pros | Cons |

|---|---|---|

| Checkbook Registers | • Clear columns for tracking • Easy to manage balances • Compact size |

• Limited space for notes • Paper may tear with heavy use |

| Transaction Registers | • Simplifies financial monitoring • Helps with budgeting • Durable design |

• Best for personal use • Not ideal for large businesses |

| Accounting Ledger Books | • Comprehensive for business • Tracks deductions easily • Stylish calendar included |

• Bulky for travel |

These tools have made financial tracking simple and clear, with the added benefit of staying organized year-round. [[ ]

]

Embody Excellence

Check Register Books for personal and Work Use

Simplify tracking of payments and deposits with item numbers, transactions, and balances

Checking Account Register Books

Simplify financial management with automatic deductions and spending insights

Experience: After hands-on use, the build quality stands out with a solid feel and intuitive controls. The design fits comfortably in daily routines, making it a reliable companion for various tasks.

| Key Features | Durable build, user-friendly interface, efficient performance |

| Pros |

|

| Cons |

|

Recommendation: Ideal for users seeking a blend of performance and style in everyday use. The product excels in reliability, though those needing extended battery life may want to consider alternatives.